In this article, we will understand how to approach simple interest and compound interest based questions.

What is interest?

If you borrow money from someone for some time, you will be liable to pay the borrowed principal + interest on that principal. This is because the person who has lent you money, expects to earn something on that principal. Hence,

Amount (A) = Principal (P) + Interest (I)

This forms the basis of all SI CI questions, that amount at the end of the period is always the summation of the principal and interest earned in the time for which the principal was borrowed or invested. The method in which the interest is calculated can vary (simple or compound). For our discussion, we are going to use the following terms

Principal (P) = Money that’s invested or borrowed

Time (N) = Time for which the money is invested or borrowed. Time is represented in terms of years. If the time is given in terms of months, convert it to years before beginning the calculation. (18 months = 18/12 = 1.5 year)

Rate of Interest (R) = If you have borrowed money from someone at this rate, interest will be calculated at R% and then at the end of the period, you will have to return the principal + interest.

What is simple interest?

Simple interest is when the interest calculation after the first year till the nth year is performed on the original principal. So if you have borrowed 10000 INR from someone at 10% for 3 years, your interest will be 1000 INR in the first year. 1000 INR in the second year and 1000 INR in the third year as well. This is because the interest calculation is on the original principal of 10000 INR.

Formula to calculate Simple Interest

Simple Interest = (Principal × Time × Rate of Interest)/100

In the above example, Simple interest at the end of three years = 10000 × 3 × 10/100 = 3000 INR

Amount at the end of the three year period = 10000 + 3000 = 13000 INR

What is compound interest?

Compound interest is when the interest calculation (after the first year) for the (n+1)th year is performed on the amount at the end of nth year. So if you have borrowed 10000 INR from someone at 10% for 3 years, your interest will be 1000 INR in the first year. For the second year, the interest will be calculated on 10000 + 1000 = 11000. 10% of 11000 = 1100 INR. For the third year, the interest will be calculated on 12100. 10% of 12100 = 1210. Hence, total interest at the end of three years = 1000 + 1100 + 1210 = 3310 INR.

Amount at the end of the three year period = 10000 + 3310 = 13310 INR

When it comes to compound interest, we have a direct formula to calculate the amount at the end of the period.

For CI, in case you are asked to find the interest, use the above formula to get the amount and then subtract the principal to get the interest.

This can be summarized in the following table as:

| Simple Interest | Compound Interest | CI – SI | |||

| Interest | Amount | Interest | Amount | ||

| Year 1 | 1000 | 11000 | 1000 | 11000 | 0 |

| Year 2 | 1000 | 12000 | 1100 | 12100 | 100 |

| Year 3 | 1000 | 13000 | 1210 | 13310 | 210 |

This tells us the following things:

- The interest and the amount for the first year is same irrespective of Simple Interest or Compound Interest

- The interest earned at Simple Interest remains the same every year whereas for compound interest, it keeps on increasing.

- The difference in the interest after the first year at SI and CI is because of the change in the principal. This difference is nothing but the interest in the previous year × (). For example: 1100 = 1000 × 1.1; 1210 = 1100 × 1.1

Let us look at a formula which can be used to find the difference between simple interest (SI) and compound interest (CI) earned at the end of two years on a certain principal (P) at rate of interest (R)

At SI, in two years, Amount = P + 2PR/100

At CI, in two years, Amount = P[1+(r/100)]^2

Difference in the interest earned =

If we use the data from the example, the difference in the interest earned at SI and CI after two years = 10000 × (10/100)^2 = 100

Similarly, one can derive the formula for the difference in the interest earned when time is three years. But it is always better to understand why this difference occurs and then use logic to calculate the difference than depend on the formula.

By now, you must have figured out that compound interest is nothing but successive percentage change. So 10000 (1.1)(1.1)(1.1) = 13310

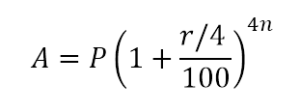

At times, semi-annually and quarterly compounding questions are asked.

Compounded semi-annually: Make the rate half of the original rate and double the time period

Compounded quarterly = Make the rate 1/4th of the original rate and multiply the time by 4

This conceptual knowledge is all you need to solve SI CI based questions. In another post, we will cover the concept of instalments which is an extension of SI CI concepts. If you have any queries, drop a line in the comments section. Read all the posts in our 75 days to CAT series by clicking here. Happy learning! 🙂